Integrated Investigative Solutions

Identify persons of interest and stop financial crimes

Solutions for Law Enforcement

A powerful integrated SAAS solution designed to aid in investigations and combat financial crimes.

Lead Generation

Lead Generation Service is a unique solution that helps law enforcement agencies identify crime scene witnesses, persons of interest and potential suspects. The geo-fence service utilizes anonymized, geo location data from mobile devices that were near a specific location within a defined period of time. Using that information and appropriate legal authority, agencies can request detailed subscriber-based information from Mobile Carriers and Internet Service Providers. Lead Generation is effective with Investigations involving homicides, human trafficking, missing persons, property crimes, narcotics, and financial crimes.

Financial Card Services

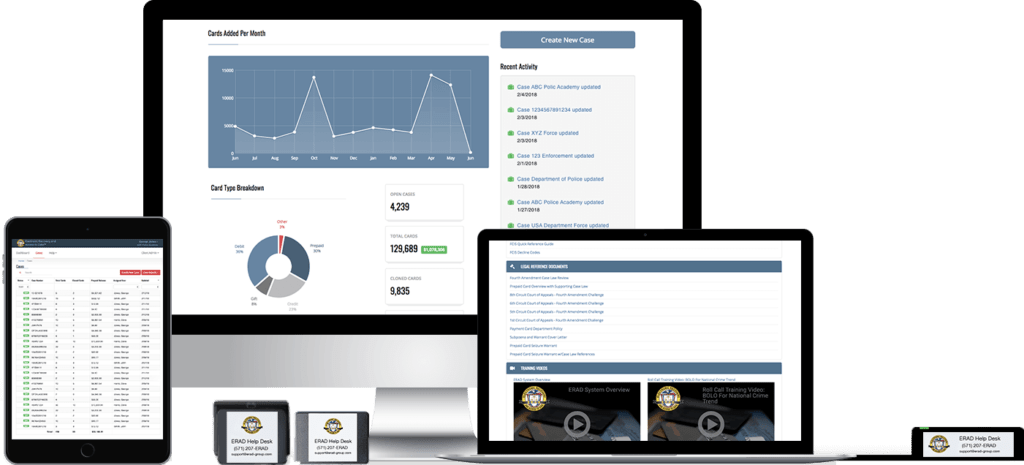

Use ERAD to pinpoint credit and debit card fraud, track card skimmers, and recover money from prepaid cards, cash applications and other digital currency—enabling law enforcement to investigate financial crimes in a matter of seconds.

ERAD’s cloud-based subscription software is easy to implement and accessible for law enforcement officers through tablets, mobile devices, or computers.

Features

Identify Persons of Interest

Identify crime scene witnesses, persons of interest and potential suspects with geo-fence services.

Check Prepaid & Gift Card Balances

Check balances on virtually any prepaid cash card including retail cards.

Identify Stolen and Counterfeit Cards

Determine legitimate payment cards from counterfeit credit and debit cards. Easily batch upload card numbers from skimmers and laptops for easy analysis.

Digital currency seizures

Seize illicit funds from prepaid cards, cash applications and cryptocurrency.

Download reports

Produce detailed Excel and PDF documents for court orders and management reports.

Deconfliction Notifications

Receive immediate notification on a phone/mobile number, credit/debit card, or MAC ID’s connected to other criminal cases.